Asset Valuation Services

|

TCR brings a multi-disciplinary, quantitative based approach to the analyses of the value of new and existing assets and contracts in energy markets. The foundation of our approach is a thorough knowledge of generation, transmission and distribution technologies and systems. We build upon that technical foundation by applying principles from economics and finance informed by the goals of utility regulation and public policy.

TCR typically uses a revenue/income approach to estimate the market value of energy assets. TCR projects the cash flow the candidate asset will produce or, in the case of load reduction assets, avoid over its economic life. TCR develops these projections by simulating the operation of the market in which the candidate is operating over an appropriate study period. For an asset operating in wholesale energy markets, TCR forecasts the revenues the asset would receive from providing capacity, energy and ancillary services in the relevant wholesale markets using ENELYTIX®, its cloud-based market modeling tool, to develop projections of prices in those wholesale markets as well as the candidate asset’s level of participation in those markets. For a distributed energy resource TCR forecasts the wholesale energy and distribution system costs its owner avoids by using its generation on-site as well as the wholesale energy and distribution service revenues its owner receives from selling its services into those markets. TCR provides analyses with rigorous results that withstand peer reviews and litigation scrutiny. We present those analyses and results clearly and convincingly to both technical and non-technical audiences. |

Representative Projects

|

Case Study

|

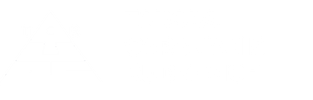

TCR’s evaluation of the costs and benefits of 40 clean energy project proposals over a 25 year study period on behalf of the Massachusetts electric distribution companies (MA EDCs) demonstrates our ability to provide rigorous analyses of the asset values of generation resources. The figure below illustrates the range of technologies and proposal sizes.

The MA EDCs solicited these proposals in order to acquire 9,450 gigawatt hours per year of cost-effective renewable energy and thereby comply with Massachusetts energy diversity and greenhouse gas (GHG) emission reduction goals. TCR prepared consistent, comparative evaluations of each hydro, solar and wind proposal independent of their size and technology but fully cognizant of their location and timing. TCR evaluated each proposal using a scenario analysis approach in which it compared the energy costs and GHG emissions under a scenario with the proposal in service to the energy costs and carbon emissions under a “but for” scenario without any of the proposals in service. TCR used ENELYTIX to simulate the operation of the New England market under each scenario. Working from a single database structure, ENELYTIX simulates the operation of the market using three modules - a 30-year, annual resource adequacy module; an hourly, nodal, 20-year plus SCUC / SCD module and a detailed capacity market valuation module. ENELYTIX operates with cloud-based technology utilizing user-friendly Excel interfacing with complex data / information transfer from an OLAP cube on the cloud to user workstations. |