Market Design Services

|

TCR brings a multi-disciplinary, quantitative approach to its analyses of market design issues. The foundation of our approach is a thorough knowledge of generation, transmission and distribution technologies and systems. We build upon that technical foundation by applying principles from economics and finance informed by the goals of utility regulation and public policy. Finally, we apply our expertise in mathematics and software development. Using this approach, senior members of the TCR team have led the thinking and development on market design in the power industry since the original work of Schweppe, Caramanis, Tabors, and Bohn on Spot Pricing. They have applied this approach to support restructuring of the electric industry throughout the world as well as the implementation of Locational Marginal Prices (LMPs) in the centralized markets resulting from that restructuring.

TCR team members have developed advanced software systems for simulating the SCUC and SCED processes used to plan and operate wholesale electric markets. The TCR team continues its leadership today with development of mathematics and software of Locational Marginal Value (LMV) and Distributed Locational Marginal Pricing (DLMP) for distribution level electric services. With affiliate Newton Energy Group, under DOE ARPA E funding and in collaboration with Los Alamos National Laboratory, TCR Team members have developed the mathematics for calculation of Locational Trade Value (LTV) of natural gas and a market structures to support co-optimization of the gas and electric markets. TCR provides analyses with rigorous results that withstand peer reviews and litigation scrutiny. We present those analyses and results clearly and convincingly to both technical and non-technical audiences. |

Representative Projects

|

Case Study

|

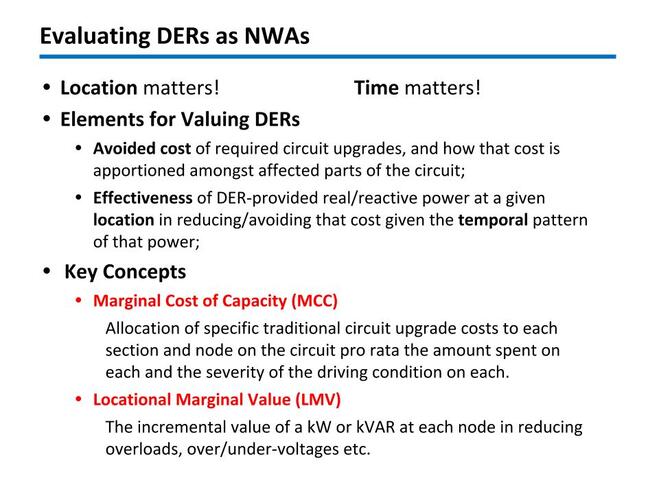

Jurisdictions throughout the US, Europe and Australia are examining approaches to improve and increase the integration of Distributed Energy Resources (DER) into the planning and operation of their electric systems as non-wires alternatives (NWA) in order to improve the efficiency and resiliency of those systems as well as to reduce carbon emissions. TCR proposes that electric distribution companies accomplish this by "getting the prices right" for capacity and energy from DER. This approach requires development of marginal costs and values for capacity and energy that are "granular" in both time and location within the distribution system, as indicated in the chart below.

Consistent with the December 2016 Utility of the Future report by the MIT Energy Initiative, TCR's reports on the value of, and markets for, DER emphasize the importance of "getting the prices right." Jurisdictions will only achieve efficient planning and operation of their electric systems if they put all resources on a level playing field by improving the accuracy of prices for capacity and energy from those resources and by giving distribution utilities a financial incentive to rely on NWA when they are less expensive than traditional infrastructure investments. Accurate price signals will improve the economic efficiency of each component of the re-architected electricity market, i.e., the wholesale energy market, the wholesale ancillary services market and the distribution level market for DER/NWA. |